What Is A Freehold Property? A Walkthrough Guide

What Is a Freehold Property?

When navigating the complex world of property ownership, you'll encounter various terms that firstly; you’ve probably...

We specialize in protecting home owners from the risks of underinsurance

Am I Underinsured?'This staggering figure highlights the widespread nature of underinsurance and underscores the importance of accurate rebuild cost estimates. Even a 10-20% shortfall in coverage can result in tens of thousands of pounds that owners might have to fund themselves...'

Read More

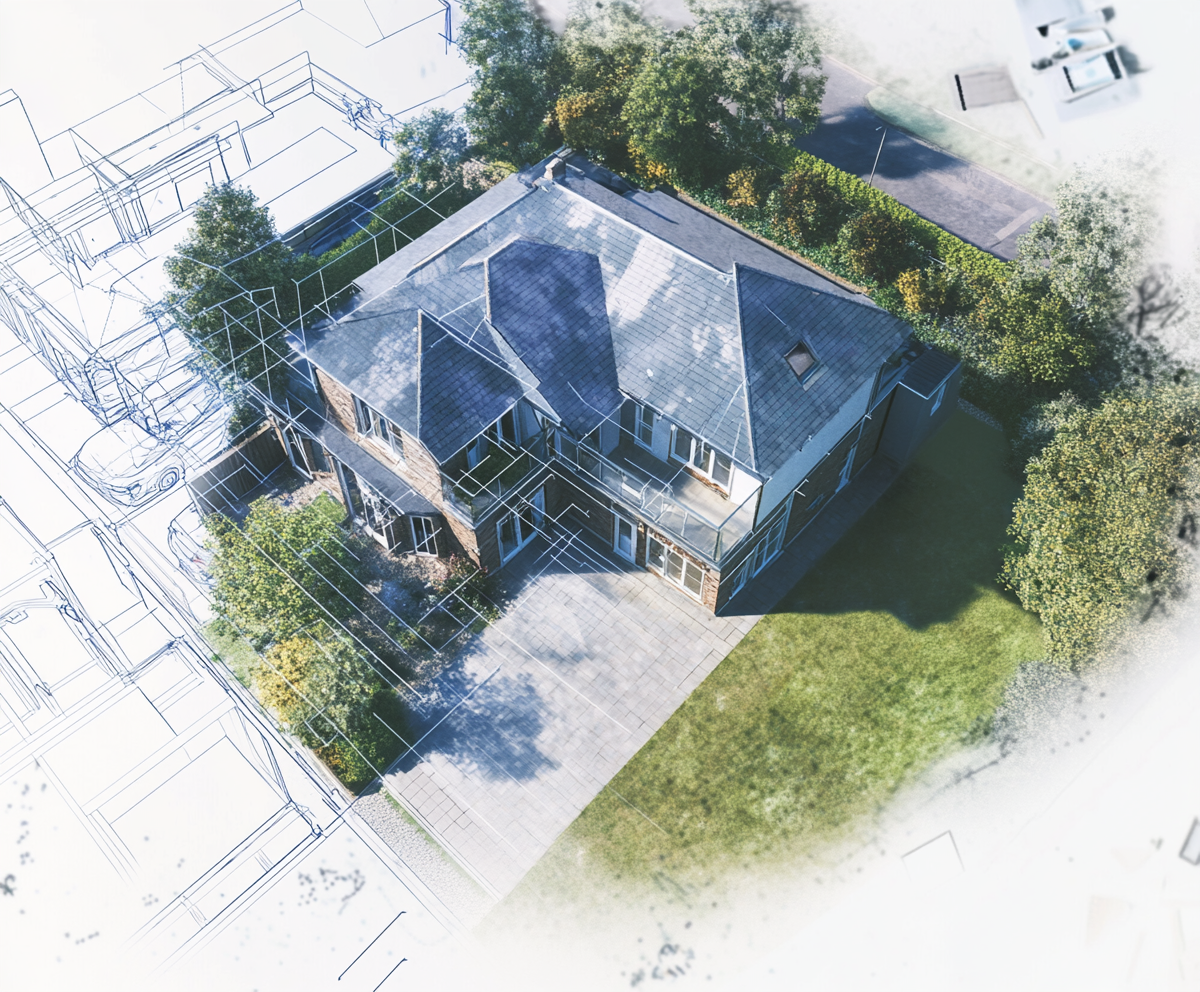

Using advanced satellite imagery and desktop measurement software, we provide accurate rebuild cost estimates tailored to your property. Backed by comprehensive cost data from real construction projects, our mission is to combat underinsurance across the UK.

As a regulated firm, we practice globally recognised standards of professionalism, integrity and transparency.

We provide a 2-day priority estimate for those of you lacking time-management skills...

We hold adequate and appropriate professional indemnity insurance that covers all estimates we provide.

When navigating the complex world of property ownership, you'll encounter various terms that firstly; you’ve probably...

If you're passionate about architecture, English history or you just loved watching Bridgerton and ended up...